Estate planning is one of the most important steps you can take to protect your legacy, your family, and your wishes for the future. It’s not just about what happens after you’re gone; estate planning can also protect you and your loved ones while you’re still here. This guide will walk you through everything you need to know about estate planning services and how they can help secure your future.

Understanding Estate Planning Services

Understanding Estate Planning Services

What is Estate Planning?

Estate planning is the process of arranging for the management and transfer of your assets and responsibilities, both during your life and after your death. A comprehensive estate plan addresses a range of issues including:

- Distribution of Assets: Determining who will receive your property, money, and valuables.

- Care for Dependents: Naming guardians for minor children or adults who need assistance.

- Medical and Financial Decisions: Appointing people to make medical and financial decisions if you are unable to do so.

- Tax Efficiency: Structuring your estate to minimize taxes and other expenses.

An estate plan can be as simple as a basic will, or it can involve complex trusts and legal arrangements tailored to specific goals and needs.

Who Needs Estate Planning?

Estate planning isn’t just for the wealthy. It’s essential for anyone who has assets, loved ones, or personal preferences they want to protect. Estate planning can benefit:

- Individuals with Dependents: Parents of young children or caretakers of dependent adults can ensure ongoing support and care.

- Business Owners: Protect the continuity and control of a business.

- Couples and Families: Helps clarify and formalize arrangements for joint or individual assets.

- Retirees: Organize wealth and provide instructions for healthcare, asset management, and gifting.

Estate planning adapts to all stages of life. Whether you’re just starting out or planning your retirement, having an estate plan provides peace of mind and a clear path forward.

Benefits of Estate Planning

Estate planning provides various benefits that can make a significant difference for you and your family. Here are some key advantages:

Protects Loved Ones: Establish a clear plan for family members to avoid potential conflicts or stress.

Reduces Taxes and Legal Costs: Minimizes estate taxes and legal fees, leaving more to your heirs.

Honors Your Wishes: Provides clarity on how you want your healthcare, finances, and assets handled.

Prevents Family Conflicts: Clear, legally binding instructions help prevent disputes among family members.

Estate planning provides the certainty that, regardless of what happens, your wishes and the needs of your loved ones are respected.

Core Components of Estate Planning Services

Wills and Trusts

Wills and trusts form the foundation of most estate plans. Each plays a unique role in managing and distributing assets.

Types of Wills

Simple Will: Outlines how your property will be distributed after death. It’s straightforward and commonly used for basic estates.

Testamentary Trust Will: Establishes a trust upon your passing to manage assets for beneficiaries. This can be useful for minor children or individuals who need support.

Joint Will: Created by two people, usually spouses, to distribute shared assets. Once one partner passes away, the will generally cannot be changed.

| Type of Will | Purpose |

|---|---|

| Simple Will | Distributes property upon death |

| Testamentary Trust Will | Creates a trust for managing assets after death |

| Joint Will | Distributes joint assets for couples |

Each type of will is suited to specific needs, and selecting the right one depends on your goals and personal circumstances.

Types of Trusts

Trusts are versatile tools that allow you to manage assets during your life and after. Some popular trust types include:

Revocable Trust: Can be modified or revoked during your lifetime. Often used to avoid probate and allow for ongoing management of assets.

Irrevocable Trust: Cannot be altered after it’s established. This type is often used for tax benefits and asset protection.

Living Trust: Created while you are alive, it allows for the transfer of assets without going through probate. A living trust is commonly used to protect and distribute assets smoothly.

Trusts offer control, flexibility, and tax advantages that can help protect your assets and simplify the distribution process for your heirs.

Power of Attorney

A power of attorney (POA) is a legal document that gives someone else the authority to act on your behalf. It’s an essential tool for managing finances and medical decisions if you’re unable to do so yourself.

Financial Power of Attorney

This type of POA grants a trusted person the authority to manage your financial matters, including:

- Paying bills and managing bank accounts

- Filing tax returns

- Buying or selling property

A financial POA can be either “immediate,” taking effect as soon as it’s signed, or “springing,” becoming effective only if you become incapacitated.

Healthcare Power of Attorney

A healthcare POA gives a designated individual the authority to make medical decisions on your behalf. This person will work with doctors and caregivers to follow your wishes for treatment, surgery, or end-of-life care.

| Type of Power of Attorney | Purpose |

|---|---|

| Financial Power of Attorney | Manages financial affairs if you are unable |

| Healthcare Power of Attorney | Authorizes medical decisions on your behalf |

Choosing someone for these roles requires careful consideration, as they will be making crucial decisions that align with your personal preferences.

Healthcare Directives and Living Wills

Healthcare directives and living wills let you communicate your healthcare wishes before a medical emergency arises.

Living Will vs. Healthcare Power of Attorney

Though often used together, a living will and healthcare POA serve distinct functions:

Living Will: Specifies your wishes regarding life-sustaining treatments (like resuscitation or feeding tubes) if you are in a terminal or irreversible condition.

Healthcare Power of Attorney: Appoints someone to make healthcare decisions if you’re unable to communicate or if situations arise that your living will doesn’t cover.

By setting up both a living will and healthcare POA, you gain control over how your medical care is handled, reducing the burden on loved ones during difficult times.

Guardianship Provisions

Guardianship provisions are a critical part of any estate plan for those with dependents who need ongoing care. Naming a guardian in your will gives peace of mind, knowing your loved ones will be cared for by someone you trust.

Guardianship for Minor Children

For parents of young children, designating a guardian is essential. This provision ensures that your children are raised by someone you choose if something happens to you.

When selecting a guardian, think about:

- Values and Beliefs: Do they share your values and parenting style?

- Stability: Are they in a steady position in life to care for your children?

- Relationship with Children: Do your children already know and feel comfortable with this person?

Choosing a guardian can be one of the most challenging decisions parents face in estate planning. A detailed letter expressing your wishes and guidance can also help your chosen guardian understand how you’d like your children raised.

Guardianship for Incapacitated Adults

If you are responsible for the care of an incapacitated adult—like an elderly parent or a family member with disabilities—guardianship provisions help ensure they continue receiving the right support.

Points to keep in mind for adult guardianship:

- Care Needs: Does the guardian have the time, resources, and willingness to provide the level of care required?

- Living Arrangements: Would the person need to move, or could they stay in their current home?

- Financial Responsibility: Is the guardian willing to manage financial decisions and healthcare arrangements?

Guardianship provisions for adults help protect loved ones and provide clear instructions for their ongoing care.

Charitable Bequests

Charitable bequests allow you to support causes you care about after your passing. Including charitable gifts in your estate plan allows you to make a lasting impact while potentially lowering the tax burden on your estate.

Types of Charitable Bequests

There are several ways to structure charitable contributions in your estate plan:

- Outright Bequests: A direct donation of cash, assets, or property to a chosen charity.

- Percentage Bequests: Leaving a set percentage of your estate to charity, so the gift adjusts with the overall size of your estate.

- Residual Bequests: The remainder of your estate after all other specific gifts have been made goes to the charity.

- Contingent Bequests: A donation that takes effect only if certain conditions are met, such as if a primary beneficiary is no longer alive.

Each option provides flexibility and lets you support a meaningful cause in a way that suits you best.

Benefits of Charitable Giving in an Estate Plan

Including charitable bequests in your estate plan offers benefits beyond personal satisfaction:

- Tax Savings: Charitable donations can reduce estate taxes, making it possible to leave more to your heirs.

- Legacy Creation: A charitable gift leaves a lasting impact that reflects your values and priorities.

- Flexible Options: You can specify how the charity uses your gift, whether for general support, a specific program, or an endowment.

Carefully planning charitable giving can provide both personal fulfillment and financial benefits for your estate.

Digital Estate Planning

Digital estate planning is now essential, with so much of our lives online. This involves organizing and making arrangements for your digital assets after your passing. Digital assets can include everything from social media accounts to online banking.

Types of Digital Assets to Include

A complete digital estate plan should cover:

- Financial Accounts: Online banking, investment platforms, and digital wallets.

- Social Media Accounts: Facebook, Instagram, Twitter, and others that may need to be memorialized or deleted.

- Subscriptions and Memberships: Streaming services, online publications, and loyalty programs that require cancellation.

- Email Accounts: Access to personal and work emails for managing communications.

Digital assets are valuable and need protection, just like physical assets.

How to Create a Digital Estate Plan

Creating a digital estate plan involves a few key steps:

Inventory Your Digital Assets: Make a list of all digital accounts, assets, and their login information.

Choose a Digital Executor: Many states allow you to appoint a digital executor who manages your digital estate. This could be the same person as your regular executor or someone else.

Document Your Wishes: Clearly state your wishes for each account—whether you want it deleted, transferred, or memorialized.

Store Information Securely: Keep the list of digital assets and passwords in a secure place, like a password manager or a locked physical document. Provide access to your executor.

Digital estate planning reduces the burden on loved ones and ensures your digital presence is handled as you wish.

Family Business Succession Planning

For those who own a family business, succession planning is essential to ensure the business continues smoothly. Without a clear plan, family businesses can face uncertainty and disputes, risking everything you’ve built.

Why Family Business Succession Planning Matters

Planning the future of a family business is essential for several reasons:

- Business Continuity: Ensures the business operates smoothly after your retirement or passing.

- Financial Security: Provides income and stability for family members who depend on the business.

- Conflict Prevention: Reduces potential disputes among family members over leadership roles and ownership.

A succession plan provides clarity and security for both the business and your family.

Key Elements of a Succession Plan

A solid succession plan typically addresses:

Leadership Transition: Decide who will lead the business after you. This could be a family member, business partner, or external candidate.

Ownership Structure: Determine how ownership will be divided. Will it remain in the family, or is a sale or merger the best option?

Training and Mentorship: Prepare the next generation by providing the necessary training and experience to run the business successfully.

Funding for Succession: Set aside funds to support the transition. Life insurance or buy-sell agreements can provide financial resources to buy out shares or support operations.

| Succession Plan Element | Description |

|---|---|

| Leadership Transition | Assigning future leaders and managers |

| Ownership Structure | Determining whether family retains ownership or sells |

| Training and Mentorship | Providing guidance and experience for the next generation |

| Funding for Succession | Financial arrangements to support transition costs or buy out ownership shares |

Preparing Family Members for Succession

Preparing family members for business succession is a gradual process:

- Open Communication: Discuss succession openly to manage expectations and address concerns.

- Clear Roles: Define the roles and responsibilities of each family member involved.

- Consider Outside Help: Sometimes, a third-party advisor can help navigate difficult family dynamics and create a fair succession plan.

By planning carefully, you help ensure that the family business continues to grow and support future generations.

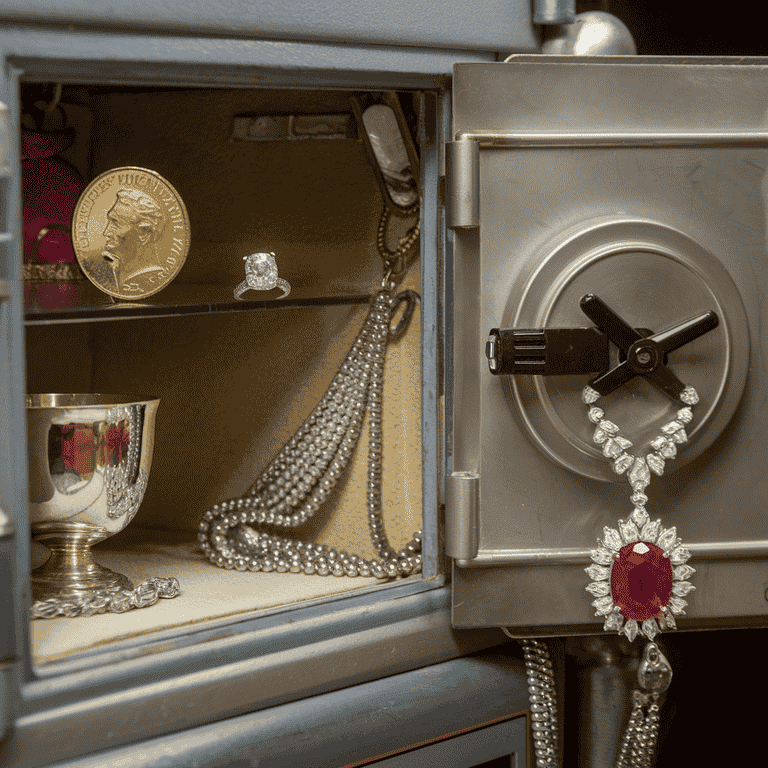

Asset Protection Strategies

Asset protection is a core part of estate planning. It’s about safeguarding your wealth from risks that could reduce its value, such as lawsuits, creditors, and unexpected life events. With a strategic plan, you can keep your hard-earned assets secure for yourself and your beneficiaries.

Why Asset Protection Matters

Asset protection offers peace of mind by reducing financial vulnerability and helping to prevent potential losses. By structuring your assets carefully, you can lower exposure to risks and secure your family’s financial future.

Common Asset Protection Tools

Several tools can help shield assets from loss or litigation. Here are some popular strategies:

- Irrevocable Trusts: These trusts transfer assets out of your personal estate. Once placed in an irrevocable trust, assets are no longer subject to personal liability.

- Limited Liability Companies (LLCs): Holding assets within an LLC can separate them from personal liabilities, providing an additional layer of protection.

- Homestead Exemptions: In some states, declaring your primary residence as a homestead protects it from creditors.

- Retirement Accounts: Many retirement accounts are protected from creditors, depending on state law and the type of account.

These tools help reduce risks and preserve assets for the intended beneficiaries.

| Asset Protection Tool | Description |

|---|---|

| Irrevocable Trusts | Transfers assets beyond reach of creditors and lawsuits |

| LLCs | Separates business assets from personal liability |

| Homestead Exemptions | Protects primary residence from creditors |

| Retirement Accounts | Often shielded from creditors, subject to state law |

Choosing the Right Strategy

Choosing the right asset protection approach depends on your specific assets and risk factors. Working with a legal advisor can help identify the best options based on your situation.

Tax Planning Considerations

A well-thought-out tax plan can significantly reduce the tax burden on your estate, leaving more for your beneficiaries. Understanding your tax liabilities now can help you prepare for the future.

Common Estate Taxes and Exemptions

Federal and state taxes may apply to estates over certain values. It’s helpful to know:

- Federal Estate Tax: Imposed on estates above a set threshold, which can vary. It’s a progressive tax, meaning rates increase with the value of the estate.

- Gift Tax: Applies to gifts made during your lifetime that exceed annual limits.

- State Estate and Inheritance Taxes: Some states have their own estate or inheritance taxes, separate from federal taxes.

Tax-Saving Strategies

There are a few methods to help reduce estate tax:

- Lifetime Gifting: Gifting assets to heirs while you’re still alive can reduce the size of your taxable estate.

- Charitable Donations: Gifts to charities can reduce estate size and create tax savings.

- Setting Up Trusts: Various trusts, such as bypass trusts, can minimize estate tax for married couples.

These strategies help lower the tax impact, increasing what’s passed on to loved ones.

Annual Gifting and Exemptions

Each year, you can gift a certain amount tax-free to as many people as you like. This annual exemption allows you to gradually reduce your taxable estate while providing for loved ones.

| Tax Planning Strategy | Description |

|---|---|

| Lifetime Gifting | Reduce taxable estate by giving assets to heirs while alive |

| Charitable Donations | Lower estate tax by donating assets to charities |

| Trusts (Bypass, etc.) | Defer or reduce estate taxes, especially for couples |

Business Succession Planning

If you own a business, having a clear succession plan is essential. This plan can ensure the continuity of your business and protect its value after you’re no longer involved.

Preparing for a Smooth Transition

An effective succession plan covers key elements, such as:

- Identifying Successors: Deciding who will take over—whether a family member, partner, or external manager.

- Transferring Ownership: Deciding how ownership will transfer, either by sale, inheritance, or gradual transition.

- Training: Preparing successors with the skills and knowledge they’ll need.

- Funding: Allocating resources to support the transition, such as life insurance or buy-sell agreements.

Ownership and Leadership Transitions

Determining who will manage the business and how ownership will transfer are core decisions. Outlining each successor’s role early on makes it easier for everyone involved.

Structuring the Succession Process

Structuring a succession plan includes setting a timeline and outlining steps to avoid disruptions. Establishing a clear process can ease transitions and ensure the business continues smoothly.

| Succession Planning Step | Description |

|---|---|

| Identify Successors | Select future leaders and managers |

| Ownership Transfer | Decide on the method for ownership handover |

| Training and Mentoring | Equip successors with necessary skills |

| Financial Backing | Set aside funds or policies for ownership transitions |

Developing and Reviewing Your Estate Plan

Estate planning is not a one-time task. Reviewing and updating your plan regularly keeps it aligned with your changing circumstances.

When to Review Your Estate Plan

Life events and changes in law are great times to review your estate plan. Situations where a review may be necessary include:

- Marriage or Divorce: Update beneficiary designations and adjust for life changes.

- Birth of a Child: Add provisions for new dependents, including guardianship.

- Change in Financial Status: Increase or decrease in wealth may require adjustments.

- Tax Law Changes: New laws can impact tax planning and other elements of your estate.

Common Updates in Estate Plans

Regular reviews allow you to keep information current. Common updates may include:

- Updating Beneficiaries: Adjust beneficiary designations on accounts and policies.

- Revising Asset Allocation: Update how assets are distributed among heirs.

- Adjusting Guardianships: Change guardianship provisions if circumstances change.

| Trigger for Review | Potential Update |

|---|---|

| Marriage/Divorce | Update beneficiary designations |

| Birth of a Child | Add guardianship provisions |

| Financial Changes | Adjust for changes in wealth |

| New Tax Laws | Revise tax-related sections of the estate plan |

Consulting with Professionals

Periodic consultations with financial and legal advisors can keep your plan up to date with any changes in laws or personal circumstances. Regular check-ins can ensure your estate plan is always aligned with your goals.

Breaking It Down for You

Estate planning is an essential process that goes beyond merely distributing assets. It includes a comprehensive strategy to protect your wealth, provide for your loved ones, and make sure your wishes are honored after you’re gone. By understanding key components—like asset protection strategies, tax planning, business succession, and the importance of regular reviews—you can build a solid foundation for your estate plan.

Engaging with legal and financial professionals can help customize your plan to your unique needs, making it a more effective tool for safeguarding your legacy. Remember, effective estate planning is not a one-time task; it requires ongoing attention and adjustments as your life circumstances shift.

Take the time to invest in your future today. A well-crafted estate plan not only brings peace of mind but also offers security for you and your family, guaranteeing that your hard work and values are preserved for generations to come.

Frequently Asked Questions

What is estate planning, and why is it important?

Estate planning is the process of arranging for the management and disposal of a person’s estate during their life and after death. It is important because it ensures your wishes are honored, minimizes taxes, and provides for your loved ones.

What happens if I don’t have an estate plan?

Without an estate plan, your assets may be distributed according to state laws, which may not align with your wishes. This can lead to disputes among family members and delays in asset distribution.

How often should I review my estate plan?

You should review your estate plan at least every few years or after significant life events, such as marriage, divorce, the birth of a child, or a change in financial circumstances.

Can I create an estate plan without a lawyer?

While it is possible to create a basic estate plan using online templates, working with a lawyer is advisable to ensure that all legal requirements are met and that your plan is tailored to your specific needs.

What documents are typically included in an estate plan?

An estate plan typically includes a will, a power of attorney, a healthcare directive, and possibly trusts. Each document serves a specific purpose in managing your assets and healthcare decisions.

How can I ensure my estate plan is followed?

To ensure your estate plan is followed, communicate your wishes to your family and appointed executors or trustees. Regularly review and update your documents to reflect any changes in your circumstances or preferences.

What are the benefits of setting up a trust?

Setting up a trust can provide various benefits, including avoiding probate, reducing estate taxes, and maintaining privacy regarding your assets. Trusts can also offer more control over when and how your assets are distributed to beneficiaries.

How does estate planning differ for business owners?

For business owners, estate planning often includes specific provisions for business succession and the transfer of ownership. It’s important to have a plan in place to ensure the continuity of the business after the owner’s passing.

Can I change my estate plan after it is created?

Yes, you can change your estate plan at any time, as long as you are mentally competent. It’s important to make updates as your life circumstances change to ensure your plan reflects your current wishes.

What role does life insurance play in estate planning?

Life insurance can provide financial security for your beneficiaries and can be used to cover estate taxes, debts, or provide a source of income. Including life insurance in your estate plan can help ensure your loved ones are taken care of after your passing.

Glossary

Asset: Any item of value owned by an individual, including cash, real estate, investments, and personal property.

Beneficiary: A person or entity designated to receive assets or benefits from a will, trust, or insurance policy upon the death of the owner.

Estate: The total assets and liabilities of an individual at the time of their death.

Estate Plan: A collection of legal documents that outline how an individual’s assets will be managed and distributed upon their death or incapacity.

Executor: An individual appointed in a will to manage the estate of the deceased, ensuring that the provisions of the will are carried out.

Healthcare Directive: A legal document that outlines an individual’s preferences regarding medical treatment and care in the event they become unable to communicate their wishes.

Intestate: The condition of dying without a valid will, leading to the distribution of assets according to state laws.

Power of Attorney: A legal document that allows one person to act on behalf of another in legal or financial matters.

Probate: The legal process through which a deceased person’s will is validated and their estate is administered.

Trust: A legal arrangement in which one party holds property for the benefit of another. Trusts can help manage assets during a person’s life and distribute them after their death.

Will: A legal document that outlines how an individual’s assets will be distributed upon their death, and may also include the appointment of guardians for minor children.

Guardianship: A legal relationship where one person (the guardian) is appointed to care for another person (the ward) who is unable to care for themselves, typically a minor.

Succession Planning: The process of planning for the transfer of an individual’s business or estate to the next generation or designated heirs.

Life Insurance: A contract that pays a specified amount to designated beneficiaries upon the insured individual’s death, providing financial security for loved ones.

Living Trust: A type of trust established during an individual’s lifetime that allows for the management and distribution of assets while avoiding probate.

Additional Resources for You

Our lead attorney, Molly Rosenblum, Esq., has meticulously crafted a wide range of resources to guide you through the intricacies of estate planning. Understanding the complexities involved, these resources are tailored to provide clarity and insight, ensuring you’re well-prepared to navigate through these essential legal processes:

Las Vegas Estate Planning Attorney: Discover comprehensive guidance and experience in estate planning, tailored specifically for residents of Las Vegas. Explore this resource.

Las Vegas Trust Attorney: Dive into the nuances of trust formation and management, ensuring your assets are protected and distributed according to your precise wishes. Learn more.

Tips on Estate Planning: Arm yourself with practical tips and insightful strategies to streamline your estate planning process, making it as efficient and thorough as possible. Read the tips.

Estate Planning Checklist: Navigate your estate planning journey with a detailed checklist, ensuring that no critical element is overlooked. Check your progress.

Making a Will: Understand the crucial steps and legal requirements involved in drafting a will, ensuring your assets are allocated according to your wishes. Start drafting your will.

Estate Planning Mistakes: Avoid common pitfalls and ensure your estate planning is foolproof by learning about the frequent mistakes to steer clear of. Learn what to avoid.

Estate Planning Probate: Gain valuable insights into the probate process and understand how meticulous estate planning can simplify or even circumvent this often complex procedure. Understand estate planning and probate.

Molly Rosenblum, Esq., through these carefully prepared resources, strives to empower you with the knowledge and tools necessary for effective estate planning. We encourage you to utilize these resources to ensure that your estate planning is as comprehensive and informed as possible.

Offsite Resources for You

Here are several offsite resources that readers may find useful:

American Bar Association – Offers a wealth of information on various legal topics, including estate planning and guardianship.

National Association of Estate Planners & Councils – Provides resources and guidance on estate planning, including a directory of estate planning professionals.

Estate Planning Council – A national organization that promotes the practice of estate planning and provides educational resources.

National Guardianship Association – A resource for information on guardianship, including standards and best practices.

American College of Trust and Estate Counsel – Provides resources and information on trust and estate law, including educational materials for both professionals and the public.

Financial Planning Association – Offers resources related to financial planning, including estate planning considerations.

Society of Trust and Estate Practitioners (STEP) – A global organization providing education and professional development for practitioners in the field of trusts and estates.

What's Next?

Thank you for taking the time to read through our resources! I hope you found the information helpful and insightful. If you have any questions or need further assistance, I invite you to schedule a free consultation with me. You can reach our office by calling (702) 433-2889. I look forward to speaking with you and helping you navigate your legal needs.